Aged Mortgage Leads by Megaleads

Alright, let’s get right into it—yes, aged mortgage leads can give loan officers and mortgage pros like you a monster return on investment. I’m talkin’ 3X, even 5X ROI in some cases, and that ain’t just marketing fluff. Here’s the scoop: these leads may be a little older, yeah, but they’re warmed up and often way cheaper than fresh-off-the-press ones. When you know how to work ‘em, it’s like finding buried treasure behind the file cabinet.

Especially in markets like aged mortgage leads New Jersey or aged mortgage leads Washington, these leads are ripe for reconnecting. You need the right game plan—and the right source, like Megaleads, which has been doing this thing longer than most loan originators have had headshots on LinkedIn.

So let’s talk about how they work, where to find the best ones, and why aged leads might be your new secret weapon.

What Is an Aged Mortgage Lead?

An aged mortgage lead is a contact who expressed interest in getting a mortgage at some point in the past, usually 30, 60, or even 90+ days ago. Unlike real-time leads that cost you an arm and a leg, aged leads are often discounted, but don’t let that fool you. They’re sitting on untapped potential.

Here’s the breakdown:

– They’ve already shown mortgage intent before

– May have just been exploring rates and options

– Could’ve been kicked to the curb by other lenders

– Now, with the proper follow-up, they’re ready to re-engage

And here’s the kicker—leads age, but that doesn’t mean they’re dead! A lot of these folks were overwhelmed with options, or the timing wasn’t right.

You can even find aged reverse mortgage leads for seniors reconsidering their financial options. Check out these insights on working with aged reverse mortgage leads and what makes ‘em such a gold mine.

Why This Matters for Your Business

If you’re a loan officer looking to keep those commission checks rolling, aged mortgage leads are crucial to your toolbox. Why? Because margins matter, and these leads offer high upside with low acquisition costs.

Here’s why they’re worth your time:

1. Low cost per lead (we’re talkin’ 60–80% cheaper than live leads)

2. Less competition since most brokers only chase fresh leads

3. Higher conversion rate when you use targeted scripts and CRM automations

And don’t overlook aged mortgage leads in places like Washington. There’s a lower saturation of agents compared to places like Cali. That means better odds for you. Take a look at this blog on aged mortgage leads Washington for market-specific tips that’ll give you the upper hand.

How to Choose the Right Mortgage Leads Source in 3 Steps

Not all lead companies are cut from the same mold. Some sell recycled garbage between five different lenders—what I call the “Hot Potato Game.” You want a reliable source that treats data with respect.

Here’s how to pick a winner:

1. Vet their data freshness intervals (Megaleads categorizes leads by age buckets: 30, 60, 90+ days)

2. Confirm compliance practices (TCPA, opt-in verification, all that good stuff)

3. Choose diversity—look for sources offering variations like VA, FHA, reverse, refi/cash-out and regular ol’ purchase leads

If you’re on the East Coast grind like me, working aged mortgage leads New Jersey has its perks. The homeowner profile tends to be steady, especially in towns with low turnover. See what I mean in this aged mortgage leads New Jersey market analysis.

Key Tools and Resources That Actually Help

I’ve been around since dial-up, so I know a game-changer when I see one. You don’t need a fancy CRM subscription costing $500/mo, but ya do need efficient tools to work these leads.

My faves:

– Power dialer like Mojo or PhoneBurner

– CRM with drip campaigns (I like GoHighLevel for bang for the buck)

– Pre-written call scripts tailored for aged leads

– Integration with your pricing engine to quote real-time mortgage rates quickly

And guess what? Some leads come bundled with auto-enriched data fields—emails, FICO indicators, even property value estimates. For a breakdown of what features to look for, swing by this mortgage leads for sale resource page.

Types of Aged Mortgage Leads and How They Work

At Megaleads, we don’t throw you the leftovers. We slice it up buffet-style so you can pick exactly which vintage you wanna chase.

Here’s what’s on the menu:

– Refinance/Cash-Out Leads: Folks looking to get money out of their homes (often sit on 50–70% LTV)

– Purchase Leads: First-time buyers who didn’t close but still wanna own something before they turn 40

– VA Refi Leads: Veterans reconsidering their VA loan benefits—super valuable as rate shifts kick in

– Reverse Leads: Seniors looking for income without tapping retirement accounts

Each one operates differently, so cater your outreach accordingly. Learn more about mortgage leads for sale in our blog, and also learn about data segmentation—it’s all connected.

Regionally Targeted Leads Yield Better ROI

It ain’t just what kind of lead you’re getting—it’s where. Working regional markets gives you the edge because you can understand the demographics, housing inventory, and lender behavior better.

For example:

– Aged mortgage leads Washington tend to come from suburban homeowners with equity-rich homes

– Aged mortgage leads New Jersey are often in probate or transition (divorce, downsize, etc.)

Megaleads offers filters by geography, property value, and more. You wanna know your turf better than Maverick knew the skies in “Top Gun.”

Check out our full suite of segmented leads by state right here: mortgage rates and regional trends.

How to Reengage Aged Leads Like a Pro

These leads need finesse. You’re not cold calling—they’ve already raised their hand once. Create a multi-touch outreach funnel that includes:

– Day 1: Personal email + soft-intro call

– Day 3: SMS follow-up with new mortgage rates

– Day 5: Leave a voicemail with urgency (rate changes, new programs)

– Day 7+: Add them to a nurturing email drip with call-to-action (CTA)

Many agents ignore leads over 30 days old. Bad move. With the right hustle, they convert better than some “new” ones. Need playbooks? We’ve got ’em, check out mortgage leads for more scripts and messaging tricks.

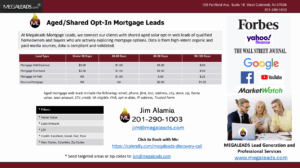

What Makes Megaleads the Go-To Source?

Now, I don’t throw praise around lightly. I’m from Jersey, remember? But I gotta say—Megaleads understands digital data better than most. Here’s what separates ‘em from the pack:

– Transparent aged brackets (none of that “somewhere between 10 and 150 days” nonsense)

– TCPA-compliant and scrubbed through third-party verification

– No overselling—limits on lead impressions per client

– Pure U.S.-based data (no sketchy international scraping)

For pros who want to scale smart with aged mortgage leads, this is your starting line. Even over on Reddit, loan officers are chattin’ up sources like ours—see what they’re sayin’ on aged leads that actually convert.

FAQ

Are aged mortgage leads worth buying?

Absolutely—aged mortgage leads have a proven ROI due to their discounted pricing and previous intent signals. The trick is follow-up and using better data tools.

Where do I find good aged mortgage leads in New Jersey?

You can source high-quality aged leads through Megaleads, which has specific targeting for areas like Bergen, Essex, and Monmouth. Learn more on our aged mortgage leads New York blog.

How are aged mortgage leads different from insurance leads?

Mortgage leads relate to loan inquiries for purchase or refinance, whereas insurance leads are about protecting assets like home, auto, or life. Different stages in the buying journey.

Can aged reverse mortgage leads be profitable?

Yes—especially now, as aging homeowners with high equity look for income alternatives. We talk more about this in our aged reverse mortgage leads deep dive.

How often should I follow up on mortgage leads?

Touch points should happen every 2–3 days during the first two weeks. After that, roll into a drip campaign. Timing is everything—your deal’s just one phone call away.

What’s the best CRM for managing aged leads?

GoHighLevel and Zoho are both affordable options that allow you to build automation flows. As long as it integrates with your dialer and pipeline, you’re in business.

Ready to dive into aged mortgage leads without burnin’ through your budget like a hot knife through cannolis?

Book a Call with us, and let’s build your lead funnel old-school smart—with modern data power.